HEAD START PRESCHOOL & EARLY HEAD START ELIGIBILITY

Eligibility guidelines: *income qualified, children with disabilities, homeless, and/or children in foster care.

At least one of the following documents are required for eligibility:

For more information please call us at

(907) 373-7000.

Income Documentation

Current Income Tax Form 1040

Current W-2 Form

Current Pay Stubs

Documentation of the following types of Public Assistance: SNAP, SSI, TANF

Additional Documents may be requested upon acceptance:

Child’s Birth Certificate

Updated Emergency Contacts

Child’s Current Immunization (including TB test)

Health Information and Consents

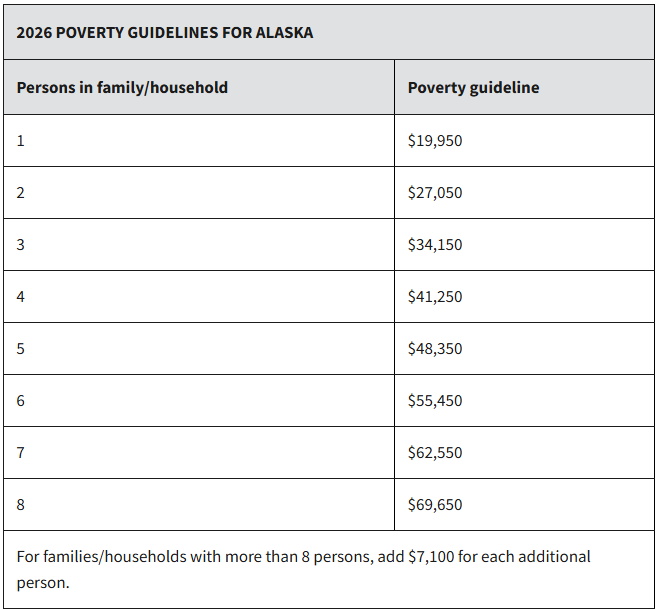

The Head Start Act establishes income eligibility for participation in programs based, in part, on the poverty guidelines updated annually in the Federal Register by the U.S. Department of Health and Human Services. Certain types of pay and allowance to members of the uniformed services is not counted as income for purposes of determining Head Start eligibility.

Head Start Program Definition of Income

Income means total cash receipts before taxes from all sources, with the exceptions noted below. Income includes money wages or salary before deductions; net income from non-farm self-employment; net income from farm self-employment; regular payments from Social Security or railroad retirement; payments from unemployment compensation, strike benefits from union funds, workers’ compensation, veterans benefits, public assistance (including Temporary Assistance for Needy Families, Supplemental Security Income, Emergency Assistance money payments, and non-Federally funded General Assistance or General Relief money payments); training stipends; alimony, child support, and military family allotments or other regular support from an absent family member or someone not living in the household; private pensions, government employee pensions (including military retirement pay), and regular insurance or annuity payments; college or university scholarships, grants, fellowships, and assistantships; and dividends, interest, net rental income, net royalties, and periodic receipts from estates or trusts; and net gambling or lottery winnings. The period of time to be considered for eligibility is the twelve months immediately preceding the month in which application or reapplication for enrollment of a child is made, or for the calendar year immediately preceding the calendar year in which the application or reapplication is made, whichever more accurately reflects the family’s current needs.

Children with disabilities

Children who have been professionally diagnosed with a disability and have a current Individualized Education Plan (IEP) or a current Individualized Family Service Plan (IFSP) are given preference. To find out more information on how to have your child evaluated, contact us.

You may fill out an application on-line or you may print, download and send your application in via fax or postal service.

Re-Enrollment

All Head Start children returning for a second year must have income re-verified. Returning students for Head Start and Early Head Start automatically are income eligible for 2 years. An Early Head Start child returning remains eligible up to age three (3). Once the child turns three (3), the family will transition to Head Start Program. The family’s income must be re-verified and must re-apply for Head Start Program.

Transfer of Students

Every child/parent has a right to transfer their child(ren) to another Head Start Region upon the availability of the Head Start, and in compliance with ERSEA guidelines and existing waiting lists when applicable.

Waiting List

All children upon applying are placed on a waiting list and during the school year for children who are not enrolled, center has met its funded enrollment until a vacancy occurs.